Why generic drugs cost so much less than brand-name versions

It’s simple: you walk into a pharmacy and see two pills that do the exact same thing. One costs $120. The other costs $4. Both have the same active ingredient, same dosage, same effects. So why the massive difference? The answer isn’t magic. It’s manufacturing cost analysis - and the system was built this way on purpose.

The generic drug industry doesn’t compete on innovation. It competes on efficiency. While brand-name companies spend billions developing new molecules, generic manufacturers focus on one thing: making the same drug as cheaply and reliably as possible. And they’ve gotten really good at it.

How much cheaper are generics? The numbers don’t lie

In the U.S., generics make up 90% of all prescriptions filled. That’s over 8.9 billion prescriptions a year. But they account for only about 16% of total drug spending. That means 9 out of 10 pills you take are cheap - but most of the money spent on meds still goes to brand-name drugs.

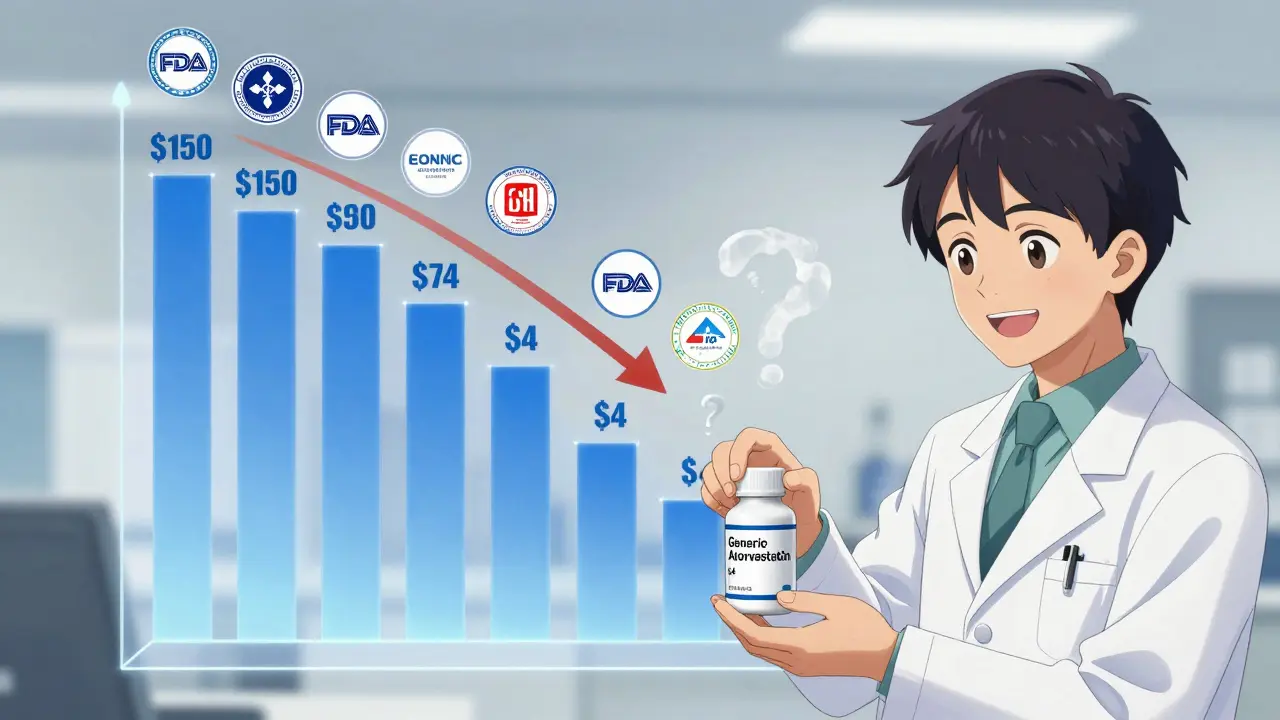

Here’s the breakdown: a brand-name drug might cost $150 a month. The generic version? $5. That’s a 97% drop. The FDA’s Average Manufacturer Price data shows generics typically sell for 40% of the brand’s price - meaning you’re paying 60% less. When six or more companies make the same generic, prices can drop over 95% from the original brand price.

Take fluoxetine (Prozac). The brand cost $110 a month in 2011. The generic? $4. Cetirizine (Zyrtec)? Brand: $120. Generic: $3. These aren’t outliers. They’re the rule.

Why the cost difference? No R&D, no ads, no patents

The biggest cost saver? Research and development. Brand-name companies spend 10 to 15 years and an average of $2.6 billion to bring a new drug to market. That includes lab research, clinical trials on thousands of patients, safety monitoring, and regulatory filings.

Generic makers? They don’t do any of that. Thanks to the 1984 Hatch-Waxman Act, they only need to prove their version is bioequivalent - meaning it works the same way in the body. That process costs $2 to $5 million and takes about 3 years. That’s 99% less in development cost.

And they don’t spend money on advertising. You never see a commercial for generic lisinopril. Why? Because no one’s trying to convince you to pick it over the brand. Doctors prescribe it. Pharmacies stock it. Patients ask for it because it’s cheap.

How generics cut costs at the factory level

Once the approval is done, manufacturing is where the real savings happen. Generic producers operate like factories, not labs. They optimize every step.

- Active Pharmaceutical Ingredients (API) - the actual medicine - make up the largest cost. But when 20 companies are buying the same API in bulk, prices drop. Some APIs can swing 20-30% in price yearly based on global supply, but generics absorb those swings better because they buy in massive volumes.

- Excipients - the fillers, binders, and coatings - are commodity chemicals. Generic makers buy them in tonnage, not grams.

- Quality control - yes, generics must meet FDA standards. But they don’t build new labs. They use standardized, proven processes. One audit, one set of procedures, repeated across millions of tablets.

- Packaging - generic pills come in simple bottles or blister packs. No fancy branding, no child-resistant caps unless required. Even the labels are bare-bones.

Here’s the kicker: for every time production volume doubles, the cost per unit drops by 18%. If you’re making 100 million tablets, it’s expensive. Make 200 million? Costs fall. Make 400 million? Even cheaper. Some generic manufacturers produce over 40 billion oral tablets a year. That’s economies of scale on steroids.

Scale is everything - and so is competition

Generic drugs thrive on competition. When only one company makes a generic, prices stay higher. But as soon as two or three more enter the market, prices collapse.

FDA data shows that with just two generic competitors, prices are already 54% lower than the brand. With five or more, they drop below 20% of the original price. That’s why you’ll see 10 different brands of generic metformin on the shelf - each trying to undercut the other.

This is a brutal business. A 1% improvement in production efficiency can mean the difference between staying in business or shutting down. Manufacturers invest in automation, continuous manufacturing, and robotics to shave off every penny. By 2027, those investments could cut production costs by another 20-25%.

Where generics struggle - and why

Not all drugs are easy to copy. Complex generics - like inhalers, injectables, or topical creams - require advanced manufacturing. The equipment is expensive. The process is finicky. And there are fewer companies that can make them.

That’s why you still see high prices for some generics. For example, generic epinephrine auto-injectors (like EpiPen alternatives) cost hundreds of dollars because only a few manufacturers can produce them reliably. Same goes for some injectable antibiotics or specialty creams.

And then there’s the supply chain. Most APIs come from India and China. When a factory there shuts down due to inspections, weather, or politics, shortages happen. In 2022, there were 350 active drug shortages in the U.S. - many linked to generic production bottlenecks.

The paradox: generics save money, but the system doesn’t always reward them

Here’s the strange part: even though generics cost pennies to make, the profit margins for pharmacies and insurers are sometimes higher on them. Why? Because brand-name drugs come with rebates, discounts, and complex contracts. Generics? No rebates. Just low price, high volume.

But that creates a weird incentive. Some pharmacy benefit managers (PBMs) make more money on brand-name drugs because they get kickbacks from manufacturers. So even though a generic is cheaper for you, the system doesn’t always push it.

And then there’s the “branded-generic” trick. Some big pharma companies own both the brand and the generic version. They sell the brand at $120, then sell the generic - made in the same factory - for $5. They make a profit on both. The generic isn’t cheaper because of efficiency. It’s cheaper because they’re playing two sides of the game.

What’s next for generic drugs?

The future is more pressure - and more innovation.

The FDA’s new GDUFA III program is speeding up approvals. Instead of 40 months, it’s aiming for 24. That means more generics hit the market faster. The Inflation Reduction Act is also forcing Medicare to negotiate drug prices - which could push generic prices even lower.

Biosimilars - the next wave of generics for complex biologic drugs like Humira - are following the same path. Their manufacturing costs are expected to drop 15% every time production doubles. That’s slightly slower than small-molecule generics, but still massive.

By 2027, generic drugs are projected to save the U.S. healthcare system $1.7 trillion over five years. That’s not a guess. It’s based on current trends, patent expirations, and volume projections.

But challenges remain. If too many small manufacturers exit the market, competition drops. If supply chains break again, shortages return. And if the U.S. keeps relying on overseas API production, geopolitical risks will keep popping up.

Bottom line: generics work because they’re designed to be cheap

Generic drugs aren’t inferior. They’re not cheap because they’re bad. They’re cheap because the system removes every unnecessary cost. No R&D. No ads. No patents. No fancy packaging. Just pure, efficient manufacturing.

And that’s why you can fill a 30-day supply of generic atorvastatin for $4 - while the brand costs $150. It’s not a trick. It’s the result of smart policy, fierce competition, and ruthless cost control.

Next time you pick up a generic, remember: you’re not getting a bargain. You’re getting the system working exactly as it was meant to.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove bioequivalence - meaning they work the same way in the body. Over 90% of U.S. prescriptions are filled with generics, and studies consistently show they perform the same clinically.

Why do some generics cost more than others?

Price differences come down to competition. If only one company makes a generic, it can charge more. When five or six companies make it, prices drop dramatically. Also, some generics use slightly different inactive ingredients or packaging, which can affect cost. But the active ingredient is identical.

Do generic drugs have the same side effects as brand-name drugs?

Yes. Since the active ingredient is identical, side effects are the same. Differences in inactive ingredients (like fillers or dyes) may cause rare allergic reactions in sensitive individuals, but this is uncommon. If you’ve had no issues with the brand, you’re unlikely to have problems with the generic.

Why are some generic drugs hard to find?

Shortages happen when manufacturing is concentrated in one or two countries, or when a single factory supplies most of the market. If that factory shuts down for inspection or due to supply chain issues, shortages follow. Complex generics like inhalers or injectables are especially vulnerable because fewer companies can make them.

Can I trust generics from other countries?

In the U.S., all generics - even those made overseas - must meet FDA standards. The FDA inspects foreign factories just like domestic ones. If a drug is sold legally in the U.S., it’s held to the same quality rules. But buying generics online from unregulated sellers outside the U.S. carries risk.

Will Medicare cover generics?

Yes. Medicare Part D plans cover most generics, often with lower copays than brand-name drugs. In fact, many plans require you to try the generic first before covering the brand. That’s because generics save the system money - and those savings are passed on to beneficiaries.

What to do next

If you’re on a prescription, ask your doctor or pharmacist: “Is there a generic version?” Most of the time, yes. And if your pharmacy says it’s out of stock, ask for another brand - there are often multiple generic manufacturers. Don’t assume the brand is better. It’s not. You’re paying for history, not quality.

Keep track of your prescriptions. When a drug’s patent expires, generic versions usually appear within months. Set a reminder to check prices a few months after a new generic hits the market. You could save hundreds a year.

Pawan Chaudhary

December 16, 2025 AT 23:47Linda Caldwell

December 18, 2025 AT 08:21Philippa Skiadopoulou

December 20, 2025 AT 03:26Radhika M

December 21, 2025 AT 20:58Jonathan Morris

December 23, 2025 AT 16:15Marie Mee

December 25, 2025 AT 02:53Erik J

December 25, 2025 AT 21:59Naomi Lopez

December 27, 2025 AT 03:52Salome Perez

December 27, 2025 AT 05:23Kent Peterson

December 28, 2025 AT 02:21Joe Bartlett

December 28, 2025 AT 09:53Jody Patrick

December 28, 2025 AT 19:48Kaylee Esdale

December 30, 2025 AT 14:58Nishant Desae

January 1, 2026 AT 05:43Meghan O'Shaughnessy

January 2, 2026 AT 20:29