PBM Rebates: How Pharmacy Benefit Managers Shape Your Drug Costs

When you pick up a prescription, the price you see at the counter isn’t the full story. Behind the scenes, PBM rebates, payments made by drug manufacturers to Pharmacy Benefit Managers in exchange for placing their drugs on preferred lists. Also known as drug manufacturer rebates, these payments are a core part of how prescription prices are set in the U.S. PBMs—like CVS Caremark, Express Scripts, and OptumRx—act as middlemen between drug makers, insurers, and pharmacies. They negotiate discounts, create formularies, and manage claims. But here’s the catch: the rebates they get from drug companies don’t always go to you. Often, they’re kept by the PBM or used to lower premiums for the insurer, leaving your out-of-pocket cost unchanged.

This system creates a strange incentive: drug makers raise list prices so they can offer bigger rebates, making their drugs look more "valuable" to PBMs. Meanwhile, you pay based on that inflated list price, even if your insurance covers part of it. For example, a drug might have a $1,000 list price, with a $600 rebate going to the PBM. Your copay is still based on $1,000—even if your insurer only pays $400 after the rebate. The PBM pockets the $600, and you’re stuck with a high cost-sharing amount. It’s not fraud—it’s legal, but it’s not transparent. And it’s why two people with the same insurance can pay wildly different amounts for the same drug.

Related entities like drug formularies, lists of medications covered by a health plan, often shaped by PBM rebate deals. and copay accumulators, policies that prevent manufacturer coupons from counting toward your deductible, often pushed by PBMs to protect rebate revenue. are directly tied to how PBM rebates operate. These aren’t random rules—they’re designed to protect the financial flow between manufacturers, PBMs, and insurers, often at your expense. Even when you use a copay card to lower your cost, the PBM may block that savings from counting toward your out-of-pocket maximum, forcing you to pay more later.

What you’ll find in the posts below isn’t just theory. These are real-world examples of how drug pricing works behind the scenes—how manufacturer coupons get limited, how generic drugs are squeezed out of formularies, and why some prescriptions cost more even when cheaper alternatives exist. You’ll see how PBM decisions connect to the medication guides you’re told to read, the copay assistance cards you use, and even the generic drugs your pharmacist recommends. This isn’t about blaming one company. It’s about understanding a system that’s been built to obscure the true cost of medicine—and how you can start pushing back.

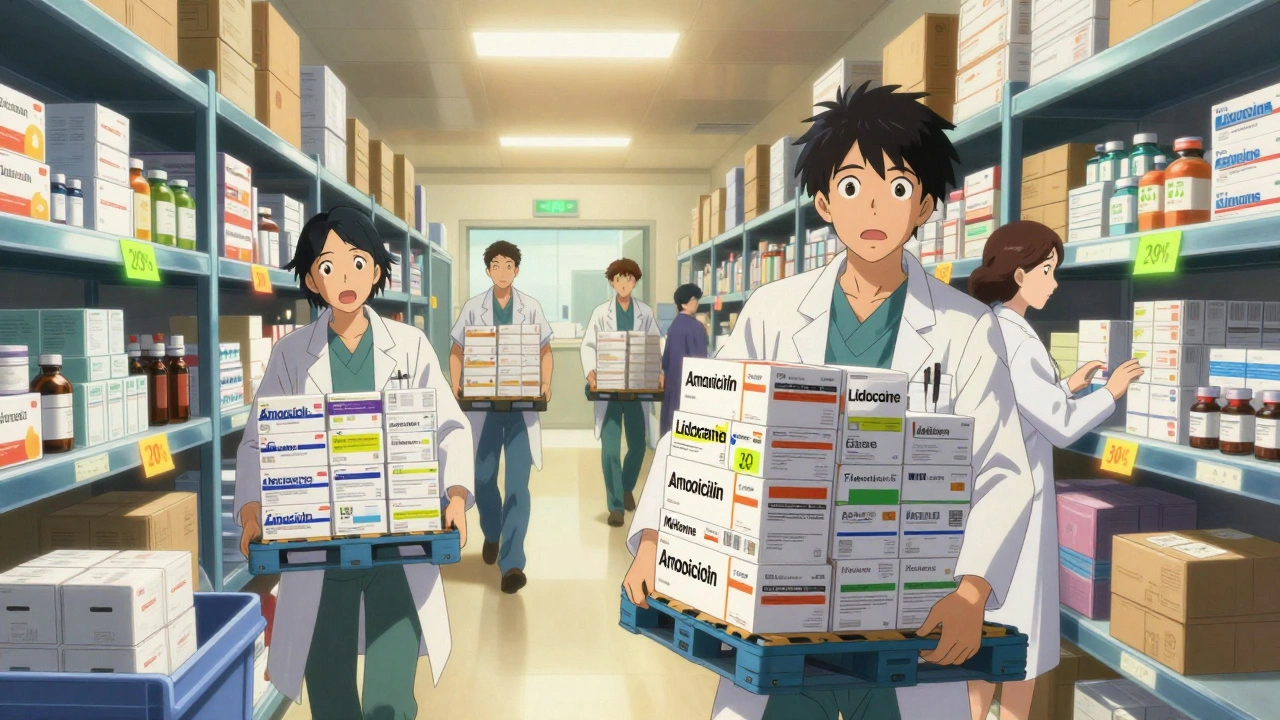

Bulk Purchasing and Discounts: How Large-Scale Procurement of Generic Medications Lowers Costs

Bulk purchasing generic medications can cut drug costs by 20% or more for clinics and providers. Learn how volume discounts, PBM rebates, and secondary distributors work-and how to start saving today.

Detail