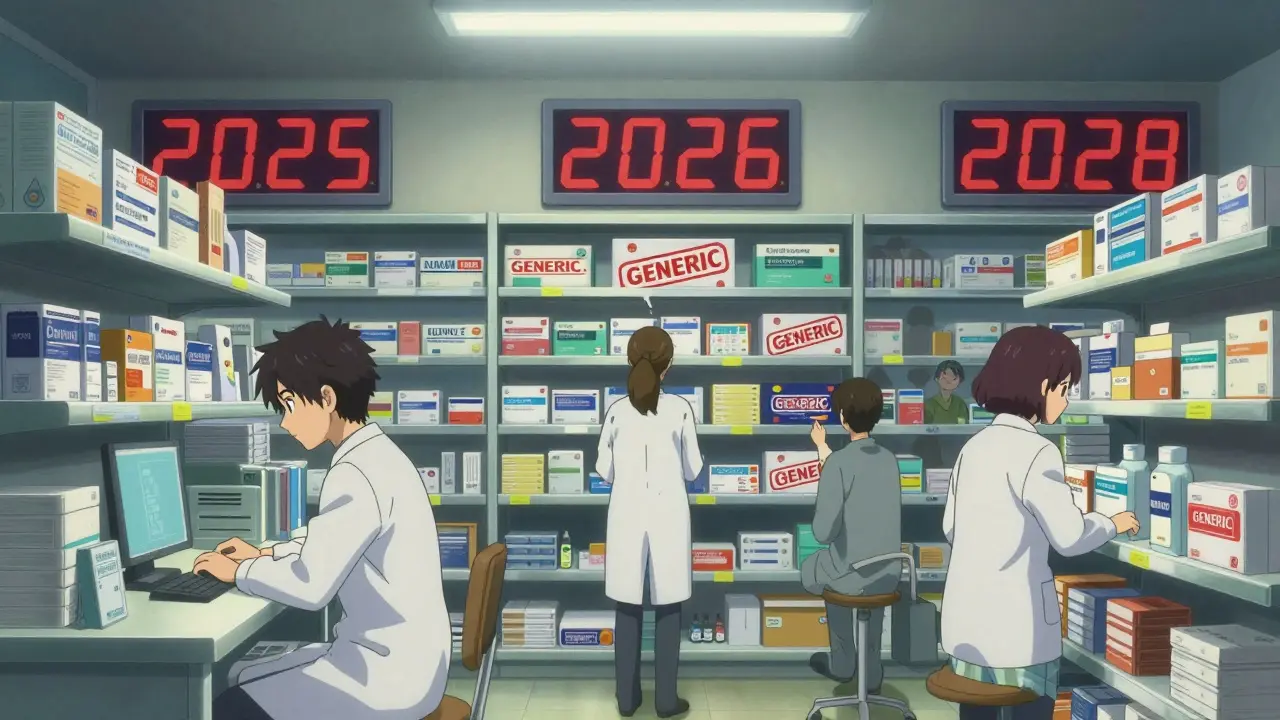

By mid-2025, the pharmaceutical world will hit a turning point. A wave of patent expirations will open the door for generic and biosimilar versions of some of the most profitable drugs ever made. This isn’t just a footnote in industry reports-it’s going to change how patients pay for medicine, how pharmacies stock shelves, and how hospitals manage treatment plans. The drugs at stake aren’t obscure niche treatments. They’re the ones millions rely on every day: heart failure meds, cancer therapies, blood thinners. And the timing? It’s not scattered. It’s a perfect storm starting in 2025 and peaking through 2028.

What’s Expanding in 2025? Entresto Leads the Way

The first major hit comes in July 2025, when Novartis’ Entresto (sacubitril/valsartan) loses its core patent protection in the U.S. This isn’t just another drug. In 2024, Entresto brought in $7.8 billion globally. It’s the go-to treatment for heart failure, especially for patients who don’t respond well to older drugs like ACE inhibitors. Right now, a 30-day supply can cost $150-$300 out-of-pocket. Once generics hit, that price could drop to $20-$40. That’s an 85% savings.

Pharmacies and hospitals have already started preparing. According to the American Society of Health-System Pharmacists, 87% of hospital pharmacy directors are updating formularies and training staff. Some are even switching patients over early. One pharmacist in Ohio told a medical forum: "We’ve already negotiated 60% price cuts with our pharmacy benefit managers. We’re not waiting for July-we’re moving now." The FDA has already approved the first generic version of sacubitril ahead of schedule, which is rare and signals how aggressively manufacturers are preparing.

2026: Eliquis Goes Generic-And the Anticoagulant Market Gets Crowded

Just over a year later, in November 2026, Bristol Myers Squibb and Pfizer’s Eliquis (apixaban) will lose protection. Eliquis raked in $13.2 billion in 2024 alone. It’s one of the most prescribed blood thinners, used to prevent strokes in atrial fibrillation and treat deep vein thrombosis. Unlike Entresto, Eliquis doesn’t have a monopoly. There are already other anticoagulants on the market-rivaroxaban, dabigatran, warfarin. So when generics arrive, it won’t be a quiet transition. It’ll be a price war.

Small-molecule generics like Eliquis typically see 80-90% price drops within a year. Market share shifts fast: 45% of prescriptions go to generics in the first month, and over 90% within two years. That’s bad news for BMS and Pfizer, but good news for patients. A 2024 analysis by the FDA found that 127 generic applications were already submitted for drugs expiring in 2025-2026. That’s 27% more than the year before. Companies like Teva, Mylan, and Sandoz are lining up to produce versions. The competition is fierce, and prices will fall hard and fast.

2028: The Big One-Keytruda’s Billion Patent Cliff

If Entresto and Eliquis are major, then Merck’s Keytruda (pembrolizumab) is the earthquake. In 2024, it generated $29.3 billion in sales. That’s more than most countries’ annual healthcare budgets. Keytruda is a PD-1 inhibitor used to treat melanoma, lung cancer, Hodgkin’s lymphoma, and more. It’s a cornerstone of modern oncology.

Its core composition patent expires in 2028. Unlike small molecules, Keytruda is a biologic-a complex protein made from living cells. That means generics won’t be simple copies. They’ll be biosimilars, which take longer to develop, test, and approve. The average time from patent expiry to biosimilar launch is 18-24 months. But even with that delay, the financial impact will be massive. JPMorgan analysts predict Merck could lose $15 billion in annual revenue within 18 months of biosimilar entry. That’s the largest single-year revenue drop in pharmaceutical history.

Merck isn’t sitting idle. In late 2024, they announced a $12 billion investment in next-gen cancer therapies, including new immunotherapies and gene-targeted drugs. They know the clock is ticking. Meanwhile, biosimilar developers are already in late-stage trials. The FDA’s Purple Book shows over 15 biosimilar applications for Keytruda are under review. But here’s the catch: oncologists are cautious. They’ve built trust around Keytruda. Switching isn’t automatic. That means market adoption will be slower than with heart or blood drugs-but still, it’s inevitable.

Why This Wave Is Different: Scale, Scope, and Speed

This isn’t the first patent cliff. Humira’s expiration in 2023 triggered the first big wave. But what’s happening now is bigger. From 2025 to 2030, 65 drugs with over $100 million in annual sales will lose protection. Together, they represent $187 billion in global revenue at risk. That’s 28% of the entire blockbuster drug market.

What makes this wave unique? Three things:

- Concentration: Most of the biggest drugs expire within a 4-year window. No other period in the last 30 years has seen this much revenue collapse so fast.

- Therapeutic importance: These aren’t just chronic condition drugs. They’re life-saving treatments for cancer, heart failure, and autoimmune diseases.

- Market imbalance: The U.S. pays 63% of the global cost for these drugs, even though it has only 20% of the patients. That means the price drops here will be the most dramatic.

For context: the average small-molecule drug gets 14 patents protecting different aspects-formulation, dosage, method of use. Biologics like Keytruda have over 130 patents. That’s why companies stretch exclusivity for years with legal battles. But the core composition patents-the ones that matter most-are finally expiring. The legal shields are falling.

Who Wins? Who Loses? The Real-World Impact

Patients win. The savings are real. The Congressional Budget Office estimates these expirations will cut U.S. healthcare spending by $312 billion over the next decade. $198 billion of that will come between 2025 and 2027. For a heart failure patient on Entresto, that could mean going from $3,600 a year to $480. For a cancer patient on Keytruda, it could mean $150,000 a year down to $20,000.

Pharmacies and insurers win too. With lower drug costs, they can reduce premiums and copays. The Association for Accessible Medicines estimates these expirations will save U.S. patients $182 billion over ten years.

But the big pharma companies? They’re scrambling. Merck, BMS, Novartis, and Amgen will collectively lose over $60 billion in revenue from these expirations. Amgen, which makes biologics for rheumatoid arthritis and cholesterol, stands to lose 52% of its 2024 revenue by 2030. That’s why they’re buying smaller biotech firms-like BMS’s $4.1 billion purchase of Karuna Therapeutics-to build new pipelines.

Generic manufacturers are thriving. Teva leads with 37 products in development targeting this wave. Sandoz and Mylan aren’t far behind. They’re investing billions in manufacturing capacity. But there’s a risk: supply shortages. When Humira biosimilars launched, some regions saw delays because production couldn’t keep up. Pharmacies are already worried the same thing could happen with Entresto and Keytruda.

What Comes Next? The Long Game

After 2030, the patent cliff won’t vanish. It’ll just shift. New drugs will come, but they’ll be even more expensive. Gene therapies, cell therapies, mRNA treatments-these are the next frontier. But they’re not cheap. And they’re not easy to copy. That means the cycle of blockbuster drugs followed by patent expirations isn’t ending. It’s evolving.

For now, the focus is on 2025-2028. The drugs are known. The dates are set. The players are in place. What happens next depends on how fast generics can ramp up, how regulators respond, and how well doctors and patients adapt. One thing’s certain: the era of sky-high prices for these life-saving drugs is ending. And for millions, that’s the best news in years.

Mike Hammer

February 13, 2026 AT 14:02Sarah Barrett

February 14, 2026 AT 11:00Daniel Dover

February 14, 2026 AT 15:51Josiah Demara

February 15, 2026 AT 17:18Kaye Alcaraz

February 16, 2026 AT 12:04Charlotte Dacre

February 18, 2026 AT 06:00Mandeep Singh

February 18, 2026 AT 16:31Erica Banatao Darilag

February 19, 2026 AT 05:26Esha Pathak

February 19, 2026 AT 10:24Chiruvella Pardha Krishna

February 19, 2026 AT 18:27