When you’re prescribed a brand-name medication that costs $2,000 a month, even with insurance, your out-of-pocket bill can feel impossible. That’s where manufacturer copay assistance cards come in. These cards, offered directly by drug companies, can cut your monthly cost to $0-or close to it-for the first few months. But here’s the catch: if you don’t understand how they work, you could face a shocking bill later in the year. This isn’t a free pass. It’s a temporary lifeline with hidden rules.

What Are Manufacturer Copay Assistance Cards?

These cards are coupons issued by pharmaceutical companies to help people with private insurance pay for expensive brand-name drugs. They’re not for Medicare, Medicaid, or the uninsured. If you have a commercial health plan-through your job, a spouse, or bought on the marketplace-you might qualify. They’re most common for specialty medications: biologics for rheumatoid arthritis, insulin for diabetes, cancer drugs, and treatments for rare conditions. These drugs often have no generic version, so manufacturers use these cards to keep patients on their brand. It’s not charity-it’s business. But for you, it’s relief.How Do They Work at the Pharmacy?

When you fill your prescription, you hand the pharmacist your insurance card and your copay card. The pharmacy processes both at the same time. Here’s what happens behind the scenes:- Your insurance pays its portion (usually a small amount).

- The manufacturer pays the rest of your copay or coinsurance-up to a yearly limit, often $8,000.

- You pay nothing-or just a small fee-right then and there.

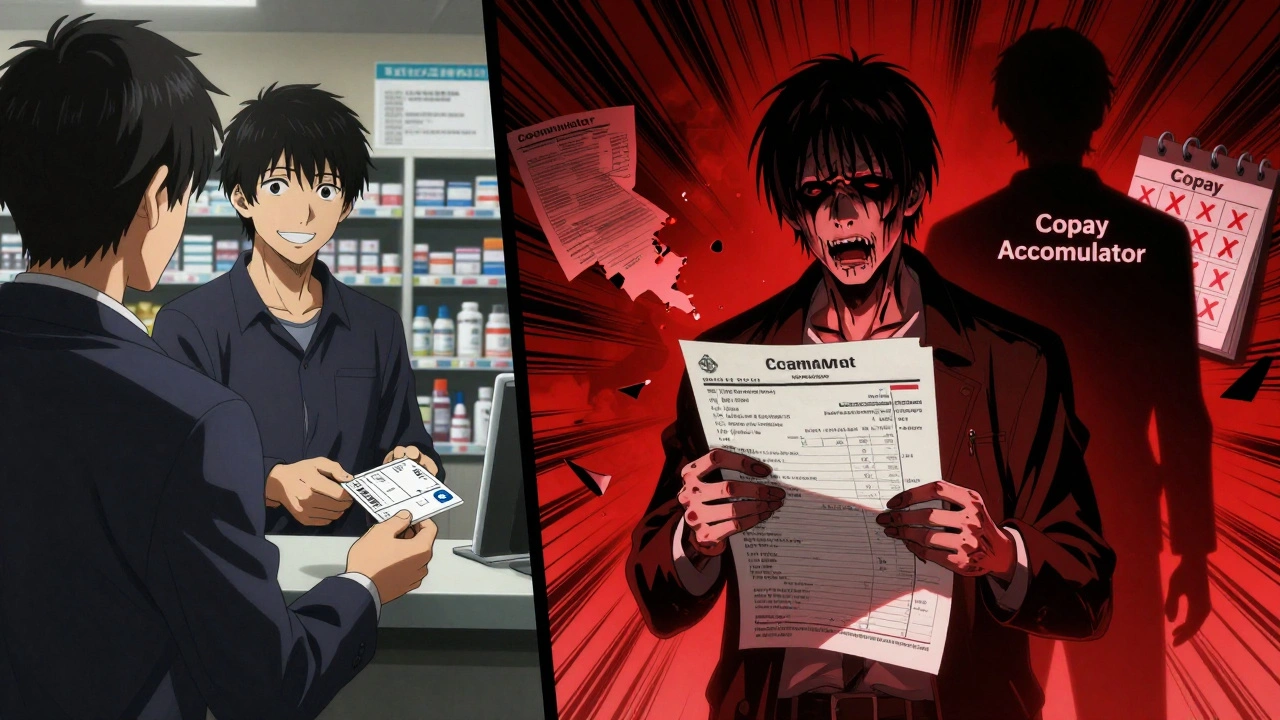

The Hidden Trap: Copay Accumulator Programs

About 70% of commercial health plans in 2025 use something called a copay accumulator program. This means the money the manufacturer pays doesn’t count toward your deductible or out-of-pocket maximum. Here’s what that looks like in real life:- You take a drug that costs $2,000/month.

- Your copay card covers $2,000 each month.

- You pay $0 for the first 4 months.

- By month 5, your card’s $8,000 limit is used up.

- You suddenly owe $2,000/month-again.

- But your deductible? Still $7,500 away from being met.

Copay Maximizers: A Better (But Still Limited) Option

Some plans use copay maximizers instead. These spread the manufacturer’s $8,000 over the whole year. So if your monthly copay is $2,000, the card covers $667 each month. You pay the rest. It’s not ideal-you still pay something every month-but at least you’re chipping away at your deductible. By the time the card runs out, you might already be close to hitting your out-of-pocket maximum. Then, your insurance covers 100% for the rest of the year. But here’s the problem: maximizers are rare. Most plans use accumulators. You need to find out which one yours uses.

How to Find Out If Your Plan Uses an Accumulator

Don’t guess. Call your insurance company. Ask:- “Does my plan use a copay accumulator program?”

- “Do manufacturer copay contributions count toward my deductible and out-of-pocket maximum?”

- “Can you send me a copy of the plan document that explains this?”

How to Get a Copay Card

You can’t buy these cards. They’re free, but only if you qualify.- Go to the drug manufacturer’s website. Search for “[Drug Name] copay assistance.”

- Fill out a short form: name, insurance info, doctor’s details.

- Most approve within minutes.

- Download the card (PDF or app version) or request a physical card by mail.

- Proof of private insurance (no Medicare or Medicaid)

- A prescription from your doctor

- Income under a certain limit (some programs have caps-usually $100,000/year for individuals)

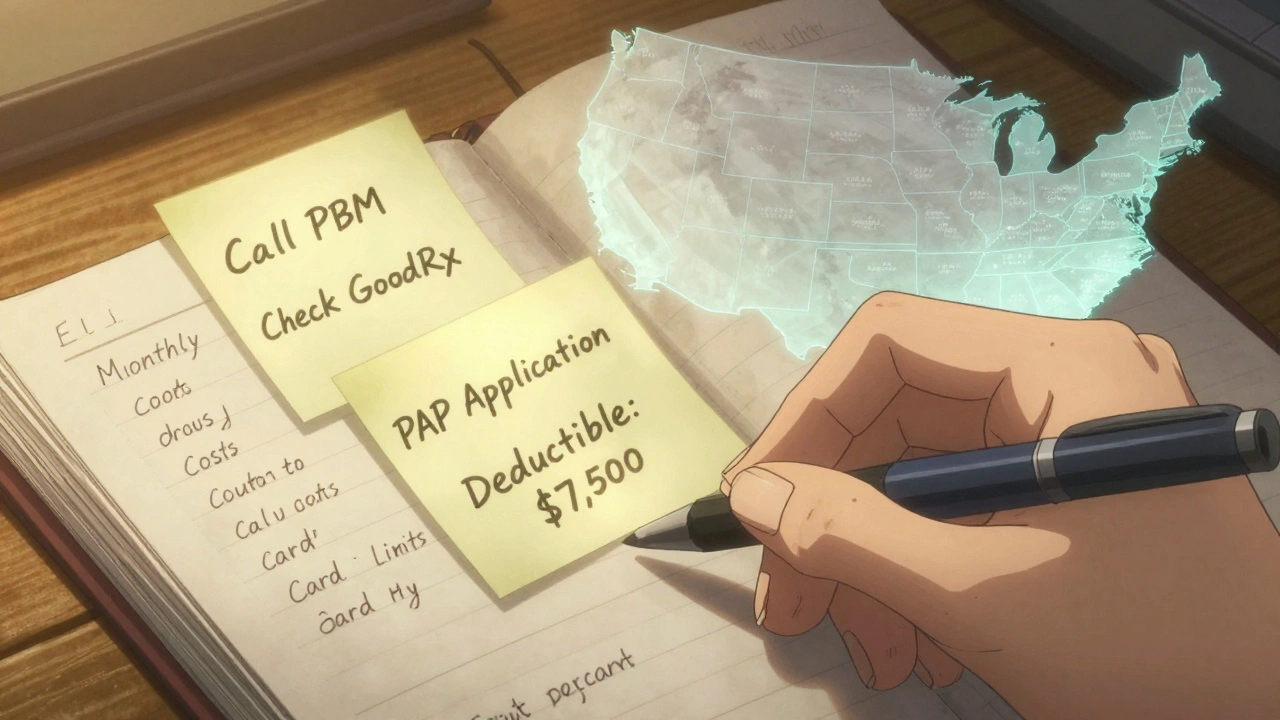

What to Do When Your Card Runs Out

Don’t wait until your last refill to panic. Set a reminder: if your card gives you $8,000 and your monthly cost is $2,000, you’ll hit the limit in four months. Mark that date on your calendar. One month before it expires, start exploring other options:- Ask your doctor if a generic or lower-cost alternative exists-even if it’s not the same drug.

- Check GoodRx or SingleCare for cash prices. Sometimes, paying cash without insurance is cheaper than your post-card copay.

- Apply for patient assistance programs (PAPs). These are run by manufacturers too, but they’re for low-income patients, including those on Medicare. You can use PAPs and copay cards at the same time if you qualify for both.

- Call your pharmacy. Some have discount programs for high-cost drugs.

Copay Cards vs. Pharmacy Discount Cards

Don’t confuse copay cards with discount cards from GoodRx, SingleCare, or RxSaver.| Feature | Manufacturer Copay Card | Pharmacy Discount Card |

|---|---|---|

| Who issues it? | Drug manufacturer | Third-party company (GoodRx, etc.) |

| Can you use it without insurance? | No | Yes |

| Works with Medicare? | No | Yes |

| Best for | Expensive brand-name drugs with no generic | Generic drugs or cash-paying patients |

| Annual limit? | Usually $8,000 | No limit |

| Counts toward deductible? | Only if no accumulator | No-this isn’t insurance |

Who Should Avoid These Cards?

These cards aren’t for everyone. Avoid them if:- You’re on Medicare Part D-federal law bans their use.

- You’re uninsured-these cards require insurance to work.

- Your plan uses a copay accumulator and you can’t afford the spike after 4-6 months.

- You’re on Medicaid or VA benefits.

Real-World Tip: Track Everything

Keep a simple log:- Monthly drug cost

- Card’s annual limit

- Months remaining until limit runs out

- What your deductible is

- What your out-of-pocket maximum is

Final Advice: Know Your Plan, Know Your Limits

Manufacturer copay cards can save you thousands. But they’re not a long-term fix. They’re a bridge-and bridges collapse if you don’t plan for the other side. If you’re on a high-cost medication, treat this like a financial plan, not a convenience. Talk to your pharmacist. Call your insurer. Ask your doctor about alternatives. And always, always check if your plan hides a copay accumulator. The system is stacked. But knowledge gives you power. Use your card wisely-and don’t wait until the bill hits to learn how it works.Can I use a manufacturer copay card with Medicare?

No. Federal law prohibits the use of manufacturer copay cards with Medicare Part D, Medicaid, or other government-funded programs. If you’re on Medicare, you cannot use these cards. Instead, use pharmacy discount cards like GoodRx or apply for the manufacturer’s patient assistance program, which is designed for low-income and uninsured patients.

Do copay cards count toward my deductible?

Only if your insurance plan doesn’t use a copay accumulator program. Most commercial plans (about 70%) do use accumulators, which means the manufacturer’s payment does NOT count toward your deductible or out-of-pocket maximum. You’ll need to call your insurer or pharmacy benefits manager to confirm how your plan handles copay assistance.

How much money can I save with a copay card?

It depends on the drug and your plan. Many cards offer up to $8,000 in annual savings. For a $2,000-per-month medication, that could mean $0 out-of-pocket for up to four months. But once the card runs out, your full copay returns-unless your plan uses a maximizer or you’ve already met your out-of-pocket maximum.

What should I do when my copay card runs out?

Start planning one month before your card expires. Contact your doctor about lower-cost alternatives, check cash prices on GoodRx, apply for a patient assistance program (PAP), or see if your pharmacy offers a discount. Never wait until your last refill-delays in treatment can be dangerous.

Are copay cards only for expensive drugs?

Mostly, yes. These cards are typically offered for specialty medications that cost over $1,000 per month and have no generic version. You won’t find them for common drugs like metformin or lisinopril. They’re designed to help patients afford high-cost, life-changing medications where alternatives are limited.

Can I use more than one copay card at a time?

Yes, if you take multiple brand-name drugs from different manufacturers, you can use a separate copay card for each. Each card has its own annual limit. But you can’t stack them on the same drug. Always check the terms-some manufacturers prohibit combining assistance programs.

Emmanuel Peter

December 5, 2025 AT 12:05This is such a scam. Drug companies don't care about you-they just want you hooked on their $2000/month pill so you can't switch to a generic later. They give you a freebie for four months, then slam you with the full price while your deductible stays at zero. It's designed to trap you. I know a guy who had to declare bankruptcy after his card ran out. This isn't assistance-it's predatory capitalism with a cute card.

And don't even get me started on PBMs. They're the real villains. CVS Caremark and Express Scripts? They're the ones pushing accumulators so insurers don't have to pay a dime. You're the sucker paying the price.

They'll tell you 'it's legal'-yeah, because Congress is bought and paid for. I've seen this happen three times. Always the same script. Free at first, then gut-punch. Wake up, people.

Ashley Elliott

December 6, 2025 AT 17:27Thank you for writing this. I’ve been through this exact scenario with my insulin, and I wish I’d known about accumulators before my card expired.

I called my PBM, and they were *so* vague-like, ‘we follow industry standards.’ I asked three times and finally got a PDF that said ‘manufacturer contributions do not apply to deductible or OOPM.’ I cried.

But I’m sharing this with my support group. And I started a spreadsheet. Month 1: $0. Month 2: $0. Month 3: $0. Month 4: $0. Month 5: $2,100. I’m not going to be blindsided again.

If you’re on a high-cost med, please, please, please do this. It’s not paranoia-it’s survival.

Chad Handy

December 7, 2025 AT 08:08Let me tell you what really happens when your card runs out. You sit there staring at the pharmacy counter like a deer in headlights while the pharmacist says, 'Your copay is $1,850.' And you just nod because your brain has shut down. You go home and Google 'how to sell a kidney for insulin' and realize it's not a joke. You start Googling 'can you legally starve yourself to avoid diabetes meds?'

And then you remember your cousin who died last year because he skipped doses to save money. And you realize the system doesn't just want your money-it wants your life. And it's perfectly fine with that.

I've been on this drug for five years. I've seen five people die. The card? It's a delay tactic. A placebo for hope. And the worst part? The manufacturer's CEO makes $47 million a year. You're not a patient-you're a revenue stream with a pulse.

They'll give you a card. They'll give you a smile. They'll give you a pamphlet. But they won't give you a cure. And that's the whole point.

I'm not mad. I'm just… done.

Augusta Barlow

December 9, 2025 AT 07:02Okay but have you considered that this is all a psyop? The drug companies don't even make the pills anymore. They outsource to Chinese labs that use lab-grown synthetic compounds that are 97% placebo. The real active ingredient is fear. They want you dependent on the *idea* of the drug, not the drug itself.

And the copay card? It's a tracking device. Every time you scan it, they log your location, your mood via pharmacy camera analytics, and your blood sugar trends. That’s why they push accumulators-they need you to keep refilling so they can collect your biometric data for AI behavioral modeling.

They’re not trying to sell you medicine. They’re trying to sell you to Big Tech. The $8,000 limit? That’s your data cap. Once you hit it, they stop collecting. But by then, you’re already hooked.

And the government? They’re in on it. That’s why they banned copay cards for Medicare-so they could redirect all the data to private contractors. You think that’s coincidence? It’s not. It’s all connected.

I’ve seen the documents. They’re redacted, but I know what’s underneath.

They’re not selling insulin. They’re selling your soul.

And they’re selling it in $2,000 increments.

Joe Lam

December 11, 2025 AT 04:15You’re all missing the forest for the trees. This isn’t about copay cards or accumulators-it’s about the complete failure of American healthcare infrastructure. You’re all treating symptoms like they’re the disease.

The real issue is that we allow pharmaceutical monopolies to exist. No generics? Because the FDA is underfunded and the patent system is a joke. No price controls? Because Big Pharma owns both parties.

Meanwhile, you’re all scrambling to find a ‘hack’ to survive a system designed to break you. You’re not solving the problem-you’re just learning how to bleed more efficiently.

And yet, you still believe in the myth of personal responsibility. ‘Call your insurer.’ ‘Use GoodRx.’ ‘Track your spreadsheet.’

That’s not empowerment. That’s gaslighting with a PDF attachment.

Real change requires systemic overhaul. Not a better card. Not a better app. Not a better spreadsheet.

It requires revolution.

Karl Barrett

December 12, 2025 AT 00:25There’s a deeper ontological layer here: the copay card is a phenomenological artifact of late-stage medical capitalism. It mediates the subject’s relationship to their own body as commodified data. The card doesn’t reduce cost-it redistributes suffering across temporal and institutional vectors.

You experience temporary relief (phenomenological euphoria), but the structural violence of the accumulator remains untouched. The card is a Hegelian Aufhebung: it negates your financial burden while preserving the capitalist logic that created it.

And yet-you still cling to it. Why? Because the alternative is confronting the fact that your life is contingent on corporate benevolence. That’s unbearable. So you optimize the card. You track it. You ritualize its use. You turn survival into a spreadsheet.

But the system doesn’t care. It’s not designed to care. It’s designed to extract.

So we must ask: is the card a tool of liberation… or a cage with velvet lining?

And if it’s the latter… what does it mean to be free when freedom is a temporary coupon?

val kendra

December 12, 2025 AT 01:43Just got my card approved for my biologic. $0 this month. I’m so grateful.

But I set a calendar alert for 30 days before it runs out. I called my doc about alternatives. I checked GoodRx-cash price is $1,700. Not great, but better than $2,000.

I also applied for the PAP just in case. Took 10 minutes. They approved me in 2 hours.

Don’t wait. Do the work now. It’s not hard. Just annoying. And worth it.

Also-tell your pharmacist you’re on a card. They know the system. They’ll help you.

You got this.

Isabelle Bujold

December 13, 2025 AT 22:20I’m from Canada, so I don’t have to deal with this nightmare-but I’ve watched my sister go through it in the U.S. and I can’t believe how broken the system is.

She had the same drug, same card, same accumulator trap. She cried for three days after her bill hit. She had to choose between rent and meds.

I told her about PAPs and GoodRx, and she finally got help. But why should she have to fight this hard just to stay alive?

It’s not just American-it’s inhumane.

Thank you for sharing this. I’m sharing it with everyone I know. No one should have to go through this.

Rachel Bonaparte

December 14, 2025 AT 07:23So… let me get this straight. You’re telling me that drug companies are giving out free money to people with private insurance… but only if they’re not on Medicare? And the government lets them do this?

And then the insurance companies say ‘oh no, we won’t count that toward your deductible’?

And you’re all just… accepting this?

Why aren’t we suing them? Why isn’t the DOJ investigating? Why is this legal?

It’s like they’re running a rigged game and calling it ‘healthcare.’

I’m not mad. I’m just… disappointed.

And honestly? I think this is all a test. To see how many people will keep trusting the system before they finally rise up.

Or just give up.

Which one are you choosing?