When you pick up your prescription, you might be surprised by the price on the receipt-even though you have insurance. That’s because most health plans don’t cover everything. You’re expected to pay part of the cost. This is called cost sharing. It’s not a trick. It’s how insurance companies keep monthly premiums lower while still helping you pay for care. But if you don’t understand deductibles, copays, and coinsurance, you could end up paying way more than you expected-especially for medications.

What Is Cost Sharing?

Cost sharing is the portion of your healthcare or medication costs that you pay out of your own pocket. Your insurance plan covers the rest. This includes three main parts: deductibles, copays, and coinsurance. Together, they determine how much you pay before your insurance picks up the full bill.Think of it like this: your insurance isn’t a magic money machine that pays for everything. It’s a shared system. You pay some now, so your monthly bill stays manageable. But if you don’t know how each piece works, you’ll get stuck with surprise bills. A 2022 survey by Healthcare.gov found that 68% of people didn’t fully understand how their deductible differed from their out-of-pocket maximum. That’s a lot of confusion-and a lot of unnecessary stress.

Deductibles: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts sharing the cost of covered services. For medications, this means you pay 100% of the price until you hit that number.For example, if your plan has a $2,000 deductible and your monthly medication costs $150, you’ll pay the full $150 every month until you’ve spent $2,000 on covered services. That’s over a year of full-price pills. After you hit $2,000, your plan kicks in with coinsurance or copays.

Not all plans have the same deductible. Bronze plans often have deductibles over $7,000, while platinum plans might be under $500. High-deductible health plans (HDHPs), which are now used by 43% of U.S. workers, require you to pay everything yourself until you meet the deductible. These plans usually come with lower monthly premiums but higher upfront costs for prescriptions.

Important note: Preventive services like annual checkups or vaccinations often don’t count toward your deductible-and you might pay nothing for them. But most prescription drugs do count. Always check your plan’s Summary of Benefits and Coverage (SBC) document. It’s required by law to show exactly what counts toward your deductible.

Copays: Fixed Fees at the Pharmacy

A copay is a flat fee you pay each time you get a service or fill a prescription. It’s usually a set amount, like $10, $25, or $50, no matter how much the drug actually costs.For example, your plan might charge a $15 copay for generic medications and $45 for brand-name ones. You pay that amount at the pharmacy counter, and your insurance covers the rest-no matter if the drug costs $20 or $200. That’s the beauty of copays: predictability.

But here’s the catch: copays usually don’t apply until after you’ve met your deductible-unless your plan says otherwise. Some plans offer copays for certain medications even before you hit your deductible. This is common for chronic condition drugs like blood pressure or diabetes meds. Always check your plan’s rules. Some insurers waive the deductible for essential medications to keep patients healthy and avoid bigger costs later.

Also, copays vary by tier. Most plans sort drugs into tiers:

- Tier 1: Generic drugs (lowest copay, often $5-$15)

- Tier 2: Preferred brand-name drugs ($30-$50)

- Tier 3: Non-preferred brand-name drugs ($60-$100)

- Tier 4: Specialty drugs (often $100+, sometimes coinsurance instead)

If your medication is on Tier 4, you might not even have a copay-you’ll pay coinsurance instead. That’s why it’s critical to know your drug’s tier before you fill a prescription.

Coinsurance: Paying a Percentage

Coinsurance is your share of the cost as a percentage. It kicks in after you meet your deductible. Unlike copays, coinsurance changes based on the price of the drug.Let’s say your plan has 20% coinsurance for brand-name medications. You get a prescription that costs $1,000. After you’ve met your deductible, you pay 20% of $1,000 = $200. Your insurance pays $800.

Now imagine that same drug costs $1,500 next month. You pay 20% of $1,500 = $300. The cost goes up, and so does your bill. That’s the downside of coinsurance: it’s unpredictable. If you’re on expensive specialty drugs for conditions like rheumatoid arthritis or cancer, your monthly coinsurance could easily hit $500 or more.

Many plans use coinsurance for specialty medications instead of fixed copays. That’s because these drugs cost thousands per month. A $100 copay wouldn’t cover the insurer’s share. So they use coinsurance to split the cost fairly. But that means your out-of-pocket cost can swing wildly depending on drug pricing.

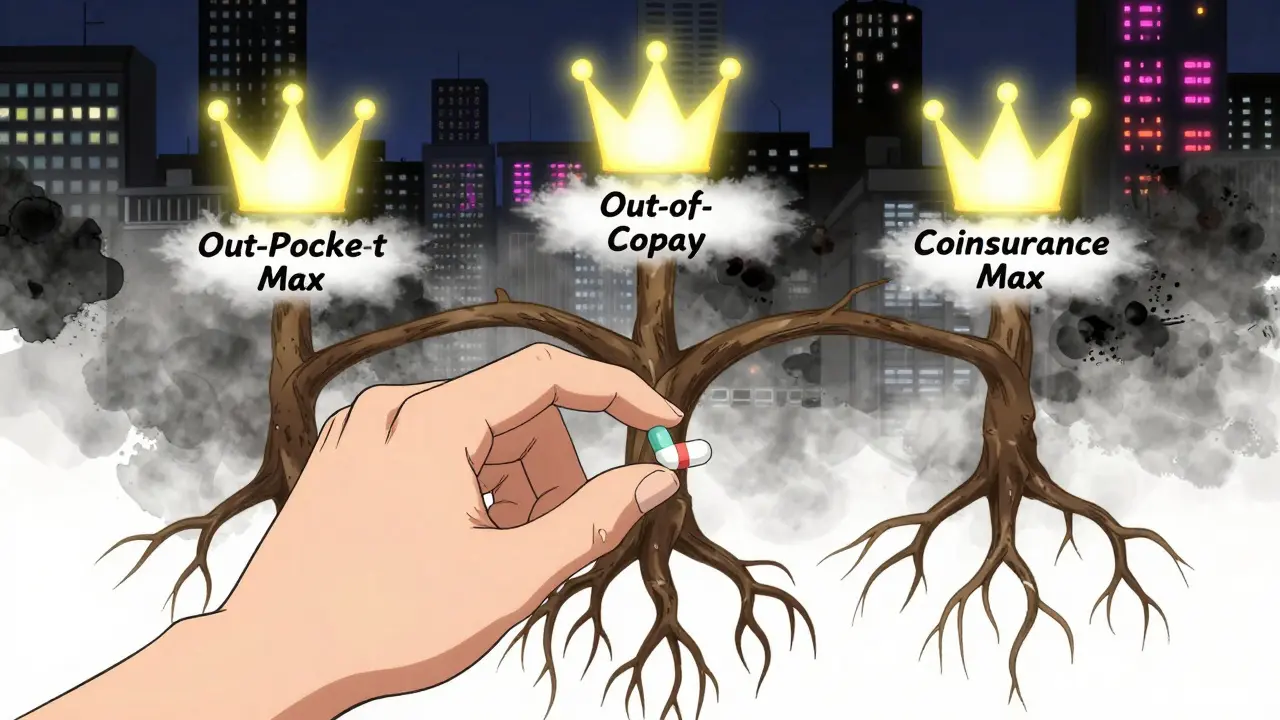

Out-of-Pocket Maximum: Your Safety Net

There’s a cap on how much you’ll ever pay in a year. That’s your out-of-pocket maximum. In 2023, the federal limit was $9,100 for individuals and $18,200 for families. Once you hit that number, your insurance pays 100% of all covered services for the rest of the year-including all your medications.Here’s the key: deductibles, copays, and coinsurance all count toward this limit. But premiums don’t. A lot of people think their monthly premium payments count toward their out-of-pocket max. They don’t. Only what you pay at the pharmacy, hospital, or clinic counts.

For someone on expensive medications, hitting the out-of-pocket max can be a lifesaver. If you take a $1,200 monthly specialty drug and pay 30% coinsurance, that’s $360 a month. In less than three months, you’re close to $1,000. By the end of the year, you’ll likely hit the cap-and then your meds are free.

How These Work Together: A Real Example

Let’s say you have a silver plan with:- Deductible: $3,000

- Copay for generics: $15

- Coinsurance for brand-name drugs: 30%

- Out-of-pocket max: $7,500

You take two medications:

- Generic blood pressure pill: $20 per month

- Brand-name diabetes drug: $1,200 per month

Month 1-10: You pay full price for both drugs because you haven’t met your deductible. That’s $20 + $1,200 = $1,220/month. After 10 months, you’ve paid $12,200-but your deductible is only $3,000. So you’ve already met it by Month 3. From Month 4 onward:

- Generic: You pay your $15 copay

- Brand-name: You pay 30% of $1,200 = $360

Your monthly cost drops from $1,220 to $375. By Month 12, your total out-of-pocket spending is $3,000 (deductible) + $15×9 (copays) + $360×9 (coinsurance) = $3,000 + $135 + $3,240 = $6,375. You’re still under your $7,500 max. In Month 13, you pay another $375-now you’ve hit your max. From Month 14 to December? Your insurance pays 100%. You get your meds for free.

What You Can Do Right Now

Don’t wait for a surprise bill. Take control:- Get your plan’s Summary of Benefits and Coverage (SBC). It’s sent to you every year. Look for the section on cost sharing.

- Check your drug’s tier. Call your pharmacy or log into your insurer’s website. Ask: “What’s my copay or coinsurance for [drug name]?”

- Use cost estimator tools. Most insurers have online tools that show estimated out-of-pocket costs before you fill a prescription.

- Ask about generic alternatives. Often, a generic version works just as well-and costs a fraction.

- Verify if your pharmacy is in-network. Out-of-network pharmacies can charge you way more, even if your plan covers the drug.

Also, if you’re on a high-deductible plan, ask if your insurer offers a drug discount program or patient assistance program. Many pharmaceutical companies offer coupons or free samples for people who can’t afford their meds-even before they hit their deductible.

What’s Changing in 2025?

The Inflation Reduction Act capped insulin at $35 per month for Medicare users-and that’s starting to influence private plans too. More insurers are now offering fixed copays for chronic condition drugs, even before the deductible is met. That’s a big win for people with diabetes, asthma, or heart disease.By 2025, 60% of plans are expected to use “value-based insurance design.” That means lower cost sharing for high-value treatments (like blood pressure meds) and higher cost sharing for low-value ones (like certain antibiotics). The goal? Reward smart healthcare choices.

And thanks to the No Surprises Act, you’re protected from surprise bills for emergency care-even if you’re taken to an out-of-network hospital. That doesn’t always apply to prescriptions, but it shows a trend: regulators are pushing for more transparency.

Final Thought: Know Your Numbers

You don’t need to be a financial expert to manage your medication costs. You just need to know three things:- What’s your deductible?

- What’s your copay or coinsurance for your meds?

- What’s your out-of-pocket maximum?

Write them down. Keep them in your phone. Talk to your pharmacist. Ask your doctor if there’s a cheaper alternative. The system is complex-but you don’t have to be confused by it. Understanding cost sharing isn’t just about saving money. It’s about avoiding financial shock when you need your medicine the most.

Do copays count toward my deductible?

Usually not. Most plans require you to pay your full deductible before copays apply. But some plans, especially for chronic conditions, offer copays before the deductible is met. Always check your plan’s rules.

Does my premium count toward my out-of-pocket maximum?

No. Your monthly premium is separate. Only what you pay at the pharmacy, clinic, or hospital-like deductibles, copays, and coinsurance-counts toward your out-of-pocket maximum.

Why is my coinsurance so high for my specialty drug?

Specialty drugs cost thousands per month. Insurers use coinsurance instead of fixed copays because a flat fee wouldn’t cover their share. For example, if a drug costs $10,000, a $100 copay wouldn’t make sense. So they split the cost-like 30% you, 70% insurer.

Can I avoid paying coinsurance by switching to a generic?

Yes. Generics are usually in Tier 1 and have lower copays-even if you haven’t met your deductible. Talk to your doctor or pharmacist about switching. Many generics work just as well as brand-name drugs.

What happens if I go to an out-of-network pharmacy?

You’ll likely pay more. Your coinsurance percentage might jump from 20% to 40% or higher. Some plans don’t cover out-of-network pharmacies at all. Always use in-network pharmacies unless it’s an emergency.

If you’re on multiple medications, consider using a mail-order pharmacy. Many plans offer lower copays for 90-day supplies. That could save you hundreds a year. And if you’re struggling to pay, ask about patient assistance programs-many drug makers offer them based on income.